ARTICLE

Income in Retirement

There are countless resources on saving for retirement, but material on income in retirement is sparse. What is more, content on saving strategies is pretty standard (save as much as possible, take advantage of any employer match plans, and allocate assets accordingly), while spending in retirement varies. Longevity, lifestyle, and assets vary from person to person, so how to budget for your retirement income needs also varies.

How to spend with confidence in retirement

Income in retirement is an important facet since some people don’t have enough income while others need a plan to account for the excess. Some retirees spend too much too quickly, while others are too frugal. Both of those scenarios present unique issues.

The earlier in your life you address this issue, the more likely you will be successful. In short, create a detailed plan. Our four-step plan includes:

- Discovery: Identify your post-retirement goals.

- Analyze: How much money will you need to fund your goals? What are your options? What is the most tax-efficient way to get there?

- Advise: Your 1834 team will prepare a customized investment strategy.

- Implementation and monitoring: Your plan will be reviewed, monitored, and updated as needed.

Sources of income

Income is often the dominant metric within retirement planning. The overarching question is frequently, “How do I replace my paycheck in retirement?” Many people find security in employment income compared to retirement income since the latter often relies on market growth.

Some of the potential sources of income that need to be accounted for and analyzed include:

- Social Security

- Pension Plans

- Retirement Savings Account

- Investment Income

- Annuities

- Part-time Work

- Passive Income Streams

- Inheritance and Gifts

- Reverse Mortgages

- Insurance Claim Payouts

Whether someone receives income from Social Security, a pension, an investment portfolio, or some combination of other income streams, reliability is extremely important for retirees. While Social Security and pensions usually are paid for life, the timing of when those payments begin can affect the amount. So, retirees’ decisions should be made on a case-by-case basis. Those who immediately take Social Security and related income streams likely have different circumstances than those who wait.

Investment income is different from Social Security and pensions because every withdrawal is taken directly from a portfolio, and the life of that portfolio is directly affected by the investment returns and the amount of the withdrawals. For decades, those in academia and the financial industry have studied this to find the maximum withdrawal rate one can take from a portfolio. There are three important goals for finding the right withdrawal rate:

- Making sure retirees do not outlive their money.

- Determining what, if anything, retirees want to leave to family, friends, and charity.

- Taking into consideration their legacy and how their funds will impact that.

The 4% rule

The 4% rule essentially suggests that one can withdraw 4% of a portfolio annually in retirement (adjusted for inflation in subsequent years) over a 30-year period without the risk of draining the account. The rule gained traction in the 1990s and is still among today's most widely used gauges.

However, this rule has been challenged recently partially because people are living longer.

Another issue that may challenge the 4% rule is inflation. Higher inflation rates may require higher withdrawal rates from client portfolios to support one’s lifestyle.

Lastly, what if returns over the next 30 years are lower than historical averages? While a 60/40 portfolio has outperformed 4% annually in the short-term, long-term results are much closer to 4% in many instances.1

The 4% rule with a tweak

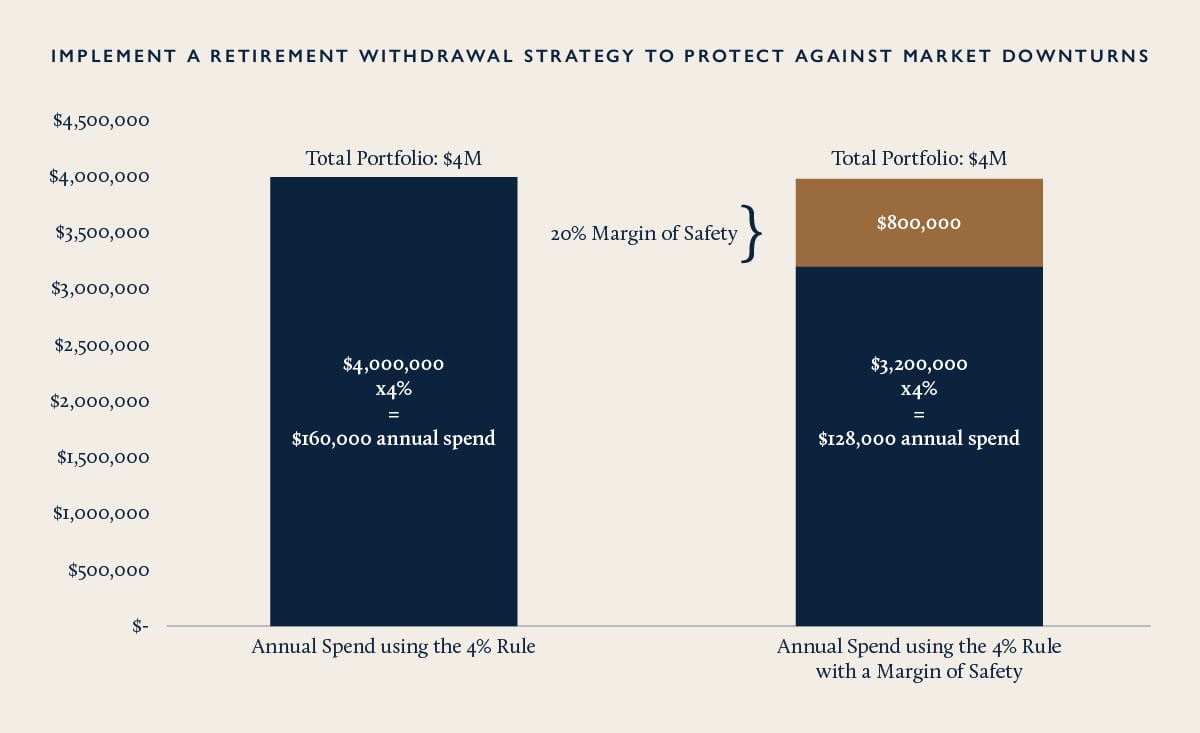

While the 4% rule is a good start, it doesn’t properly account for market volatility that occurs.

Planning conservatively could involve using the 4% rule but discounting your portfolio value by 20% when calculating it. While a 20% market drop is extreme, using 4% in that scenario guards against the most severe economic conditions.

In addition to using the 4% rule based on a 20% “discount” of your portfolio’s value, it is often wise to have three years’ worth of cash readily available to avoid dipping into the principle of an investment account. Rarely has the market ever gone down 20% in a year, and such downturns have never lasted more than three years—that is the rationale for 4% at 80% of a portfolio and three years’ worth of cash.

Mind Inflation

When inflation is elevated, it often impacts retirees more than other market participants.

Retirees (by definition) typically do not participate in the silver lining of high inflation, which is higher wage growth. Wage growth is often a factor in overall inflation, but it also takes some of the sting out of higher prices for goods and services. Retirees only experience the downside of this equation.

On a related note, many retirees have fixed income in their portfolios. Fixed income pays out a fixed dollar amount, regardless of what is happening with inflation. The higher the inflation, the greater the erosion of those bond interest payments' "real" value.

Also, an uptrend in inflation usually leads to higher market interest rates, which directly causes bond prices to decline. So, the average retiree's portfolio market value generally declines due to the large allocation to bonds.

Investment strategies in retirement

Investing in retirement is an important component of retirement income. Market gains during retirement years can supplement income needs and provide considerable returns.

Uses of liquidity

Contrary to the consensus within the investment industry, the great investor Howard Marks has said that he doesn’t view risk as synonymous with an asset’s volatility, saying instead that he defines risk as “the probability of loss.” Marks’ point is that the volatility of an asset only truly matters if an investor sells that asset at a time when volatility brought its market price lower.

Selling assets at a loss is typically done either (1) out of fear of further price declines or (2) because the investor needs liquidity and can’t get it from better sources. Leaving the behavioral finance subject (e.g., loss avoidance) aside for now, we can extract something very useful from this bit of wisdom and apply it to how we think about investing for and during retirement. That is, the concept of investment time horizon and how it becomes particularly critical in the retirement phase. “Time horizon” sounds a bit ambiguous and abstract, but what it really boils down to is, “How long before I need to sell something (or everything) to satisfy some need or desire?” To connect these ideas to the retirement portfolio, we need to sketch out how liquidity needs impact an investment strategy.

At one extreme, if we’re certain that the portfolio’s principal value will never need to be touched to support any spending needs, then we ought to simply allocate to the highest risk/highest return assets and let it compound with no concern whatsoever for volatility (hooray for our beneficiaries!). On the other extreme, if we know that we will need to spend cash equal to the portfolio’s value within, say, a month from now, then the only prudent choice is a 100% allocation to riskless assets. Notice in those two extreme cases the commonality regarding certainty—either that there will be no need for liquidity or imminent need. What’s much more likely for real-life investors is some element of uncertainty around the need to pull from the portfolio to satisfy liquidity needs. Uncertainty demands caution, which translates to taking less investment risk.

Enter planning. The lesson we are ultimately drawing from Marks is that the better we’re able to plan for future cash needs, the better equipped we’ll be to optimize the investment portfolio to maximize returns while minimizing the probability of falling short of supporting those needs.

Spending rules make less sense and fall short when it comes to multi-generational legacy planning for those who run a virtually zero risk of outliving their savings. A Liability-Driven approach can make sense, which we address separately.

Solutions

Financing retirement is a complex and stressful issue for many. Retirement planning goes far beyond any simple rule or social media post. There is no universal or simple solution for solving retirement income needs. Yes, setting a certain percentage that retirees can withdraw from a portfolio is a decent starting point, but many factors need to be considered. Among those that 1834 can help with:

- Asset placement

- Tax strategies and future tax rates

- Investment strategies that focus on income

- How much to leave to beneficiaries

- Roth conversions

- Social Security analysis

The bullets directly above are best examined by executing a financial plan. A plan that encompasses all of these factors and projects an outcome as well as the likelihood of realizing that outcome. If the outcome is low, adjustments can be made proactively (less spending, more aggressive investing) to increase the plan's chances of success.

Reach out with questions

Regardless of what the safe withdrawal rate is believed to be, what matters most are your goals. If you want to accumulate assets in retirement, you probably shouldn’t rely on a simple withdrawal rule. This is no more accurate than determining an asset allocation based solely on age. Quantifying how much one can spend in retirement should be solved on a case-by-case basis using a custom approach for each retiree.

Working with a wealth advisor at 1834, a division of Old National Bank, will start you on a financial path that provides clarity and confidence for living in retirement. As always, reach out with any questions.

1 1 Morningstar, State of Retirement Income 2024 https://www.morningstar.com/lp/the-state-of-retirement-income