About Us

Discover About Us

Our Timeline

Where it all began

Growth after 50 years

Wealth management services offered

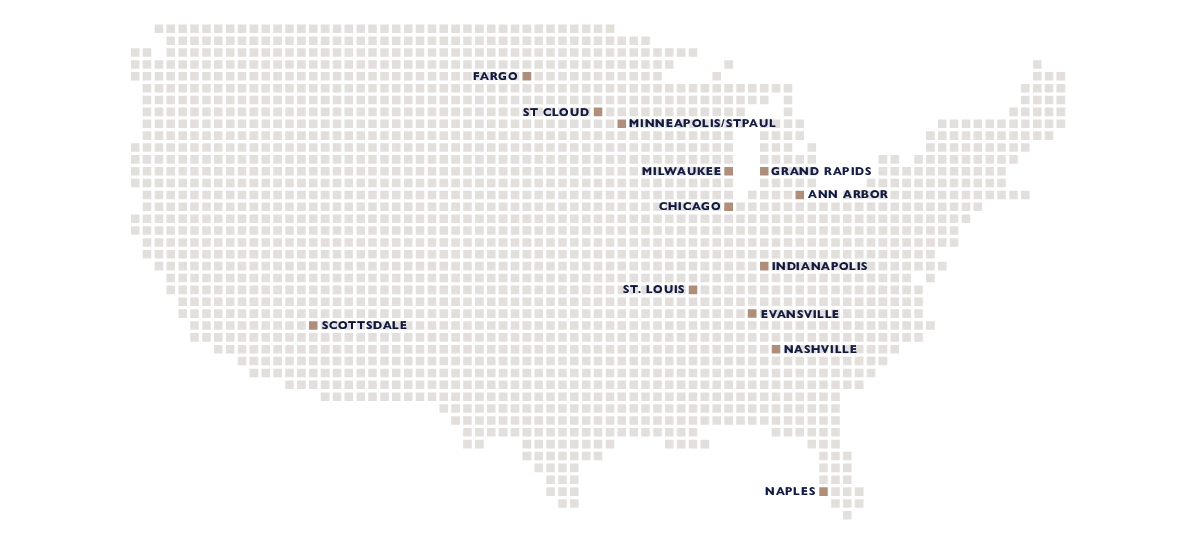

Expansion across Midwest

Doubles in Size

1834 Debut

Top 5 Reasons to Choose 1834 Wealth Management™

Top 5 reasons to choose 1834 for all of Wealth Advising needs:

We model an approach to customized, holistic service that readily competes with those of ultra-high-net-worth firms. Yet, we don’t have the minimum asset size requirement of $50 million+ that often comes with those companies.

You want a smart, experienced team focused on your financial picture. Yes, we’ll show you degrees and certifications. But we’ll also bring you examples of proven experience and work in the trenches – including established investment strategies and performance metrics that demonstrate our capabilities to earn your trust and deliver as promised.

Our goal is to build a life-long relationship – rooted in sincerity and trust – with you, our valued client. We pride ourselves in offering a tailored approach to wealth management through boutique-style practices. We serve hundreds of clients – not hundreds of thousands.

Many of our team members have been with us for more than three decades. Plus, we proactively pursue up-and-coming talent with the mindset of hiring professionals for whom we envision a long-term career at 1834. Smaller firms are often tied to a single owner or limited number of partners whose retirement may force a sale or closure. We’re focused on longevity through succession planning – ensuring the next generation of leadership at 1834 can effectively serve the next generation of clients.

While our firm provides our clients direct access and concierge-like services, our parent company, Old National, provides peace of mind when it comes to financial strength and stability. This affiliation also opens doors to broader financial services and access to resources that independent firms often lack.

Our 3-step approach to unparalleled client service

-

Step 1: Listen & Plan

Achieving your financial success, as you define it, is our priority.

We begin with understanding how you live your life today and your priorities for the future. Then, we will work with you to create a comprehensive financial plan to pursue your goals with confidence.

Our goal: Create a customized, adaptable wealth plan that evolves as you do.

-

Step 2: Define & Apply the Strategies

We’ll pinpoint important factors that are specific to your situation, such as your investment objectives, time horizon and risk tolerance. From there, we develop a personalized asset allocation strategy for your portfolio.

We’ll also explore advanced planning strategies – such as estate and wealth transfer planning, philanthropy endeavors, and/or business succession planning.

Our goal: Implement your client-specific strategy with the guidance of our integrated financial experts.

-

Step 3: Connect & Adapt

Our job is to earn your trust and simplify the wealth management process. We’ll develop a communication plan that works for you – from online account access, to recurring performance updates, to annual reviews.

As your priorities change or if financial needs become more complex, we’ll manage your wealth with flexibility, applying the right resources and strategies in the process.

Our goal: Build a life-long relationship as your trusted financial consultant.